California Construction Loans: Fund Your Next Build

Construction loans are a specialized financing tool that help property developers achieve their commercial project goals. Unlike traditional mortgages, these short-term loans offer financial solutions during construction when conventional financing methods prove inadequate. Every state has its own set of rules and specifications when it comes to construction financing. Therefore, it is important to familiarize yourself with the policies of your state before taking action.

California’s construction loan environment presents both unique benefits and obstacles, which is why it is advisable to navigate with caution. The state’s strong real estate market provides ample opportunity, but stringent regulations and high costs mean only well-informed decisions will yield desired results. This guide will provide essential information about the different types of loans and how to obtain the one to need. We will also explore the pros and cons of each loan so your decision-making process can be seamless and stress-free!

If you’d like a quicker or more specific answer to your construction loans questions, call the experts at

TMC Engineering! If you reside in Southern California, we can help guide you on efficient and trustworthy solutions. We have a team of experts waiting to help you with any of your commercial construction needs.

Construction Loans in California: What You Need to Know

A construction loan offers short-term funding to pay for construction expenses before permanent financing kicks in. Construction loans usually run up to 18 months, spanning from the construction phase till you are able to obtain a conventional mortgage or permanent loan.

California construction loans are quite different from those in other states. High California property values translate to larger loans, and the strict environmental laws can prolong the duration of such projects. Moreover, seismic requirements in California also complicate construction plans, both in terms of costs and approvals.

The competitive real estate market in the Golden State presents developers with special opportunities. While construction loans tend to come with higher interest rates, many lenders understand the long-term value of well-planned commercial projects. Down payments of 20-30% are standard, but knowledgeable developers can turn that upfront investment into lasting success.

How Do Construction Loans Work in California?

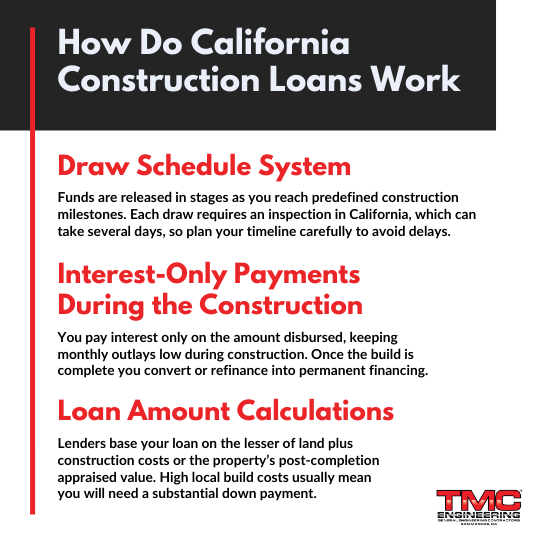

Draw Schedule System

California construction loans are on a draw schedule system where the funds are disbursed at pre-arranged construction milestones. Instead of getting the entire loan at once, you’ll have access to funds as you reach certain stages of your project. The system is for the protection of lenders while ensuring that you have sufficient capital to carry on building.

Your lender will need complete construction plans and a detailed timeline before approving any draws. Every draw request usually initiates an inspection to confirm work completion. Inspections in California take several days because of the state’s stringent requirements, so plan ahead to avoid construction delays.

Interest-Only Payments During the Construction

The majority of California construction loans have interest-only payments while the project is being built. You will only pay interest on the amount drawn, not on the full loan amount. This way, your monthly payments are low while your project is not raking in any income.

After construction, you’ll want to switch to permanent financing or refinance the construction loan. This process of conversion is referred to as a

construction-to-permanent loan. It bridges the gap between construction and occupancy smoothly. Most lenders in California provide this as an option to make financing easier and more convenient.

Loan Amount Calculations

California lenders usually determine loan amounts based on the lesser of two figures: construction cost plus land value, or the estimated appraised value after completion. Due to California’s high construction costs, expect to pay a significant out-of-pocket rate on top of what the lender provides.

Your construction loans will account for California’s special building needs, such as seismic retrofits and environmental compliance expenses. Ultimately, these extra requirements can add up to your overall project cost. And, in commercial construction, precise cost estimates are important for loan approval.

How to Get a Construction Loan in California

Step 1: Get your financial documents ready.

Start by accumulating your financial documents, such as tax returns, bank statements, and income verification. California lenders need such an extensive amount of documentation because of the complicated regulatory structure of the state. Your credit score would need to be above 680 in order to successfully qualify for favorable loan terms.

Step 2: Create detailed construction plans.

Develop detailed construction plans that comply with California building codes and environmental laws. Your plans should have architectural drawings, engineering details, and previous project performance. Most lenders need the approval of a licensed California architect or engineer before moving forward.

Step 3: Choose your construction crew.

Select contractors with experience and knowledge of California building codes and requirements. Your lender will also require verification of contractor licensing, insurance, and previous project performance. Local expertise is especially beneficial considering California’s specific building demands.

Step 4: Shop for lenders.

Shop around and compare several California lenders to secure the best rates and terms. Credit unions and community banks tend to be more favorable options compared to national lenders. These institutions may offer easier access, personalized service, and unique flexibility. There’s also a higher chance that they understand the local market, which may be beneficial depending on the project.

On the other hand, bigger institutions may offer better rates and more extensive options. For example, these organizations often have an abundance of programs that are specific to different projects. They also have access to higher capital, offering the leniency of competitive rates.

Ultimately, it’s important to factor in your project type, budget, and end goal. Figure out which lender best suits you and your company’s needs, and focus your search in that specific market.

Step 5: Submit your application.

Finance your loan application with any necessary documentation. California’s extensive approval process generally lasts 30-60 days, and possibly longer depending on the project type. Expect several rounds of questions and document requests.

What Are the Best Construction Loans in California?

Conventional Bank Construction Loans

Large California banks have full-service construction loan programs with competitive pricing. These programs usually have variable interest rates that vary monthly according to changes in the prime rate. Traditional banks are stable and have set procedures, though approval criteria are generally tougher.

California bank construction loans typically carry conversion options to permanent financing. Although you may have higher qualification requirements and lengthy documentation to contend with, this facility saves you from having to reapply to separate loans after construction.

Pros:

- Well-established lending procedures and seasoned underwriters

- Competitive interest rates for qualified borrowers

- Complete loan programs with multiple options

- Deep customer support and local presence

Cons:

- Stringent qualification criteria and voluminous documentation

- Longer approval timeframes than other lenders

- Limited flexibility for special project needs

- Increased down payment demands

Credit Union Construction Loans

California credit unions will often provide personalized service and more flexible terms than regular banks. More specifically, member-owned credit unions tend to have superior rates and more flexible approval processes. You may also find that credit unions have tighter relationships with local contractors and suppliers.

These institutions are familiar with California's special construction requirements, enabling them to provide more realistic project completion timelines. Loan amounts can be smaller than those offered by larger banks, though, and membership requirements can limit accessibility.

Pros:

- More flexible qualification requirements

- Personalized service and local knowledge

- Competitive rates for members

- Knowledge of local construction issues

Cons:

- Small loan sizes relative to big banks

- Membership requirements can limit access

- Reduced branch outlets and internet services

- Limited construction loan programs

Private Construction Lenders

California private lenders provide speed and flexibility that cannot be matched by traditional institutions. The private lenders focus on construction lending and tend to approve loans in a matter of days, not weeks. Private lenders especially help developers with unusual projects or strict deadlines.

Private lender interest rates are generally higher than standard bank rates due to their increased risk tolerance and quicker approval times. These lenders usually deal with unable to secure conventional financing, so they represent worthwhile options for complicated projects.

Pros:

- Quick approval and funding procedures

- Flexible qualification requirements

- Readiness to fund innovative projects

- Individual attention and service

Cons:

- Interest rates are higher than conventional lenders

- Shorter loan periods and more stringent repayment timetables

- Fewer regulatory controls and safeguards

- Potential for predatory lending practices

Construction-to-Permanent Loans

This hybrid option mixes permanent mortgage financing and construction financing into one loan. California borrowers enjoy locked-in permanent rates and streamlined processes. You'll save the expense and complexity of multiple loan applications and closings.

Construction-to-permanent loans provide rate security during volatile interest rate periods. However, you'll commit to permanent financing terms before construction begins, limiting your ability to shop for better rates later. The convenience often comes with slightly higher rates than separate loans. Furthermore, the loan will typically increase after construction is complete.

Pros:

- One-time loan application and closing process

- Rate protection for permanent financing

- Simplified documentation and approval

- Lower closing costs and fees

Cons:

- Restricted capacity to shop for permanent financing

- Slightly more than individual loans

- Commitment to terms before construction begins

- Fewer lender choices for this type of product

California's construction loan market offers diverse options for developers willing to navigate the state's complex requirements.

Successful construction project management becomes essential when managing loan draws, inspections, and construction timelines. Your lender selection must match your project schedule, budgetary requirements, and risk tolerance. Keep in mind that California's particular challenges demand expert knowledge and meticulous planning to ensure successful project completion.

The dynamic real estate market in the state still affords opportunities to knowledgeable developers. If you know your financing options and plan carefully, you can obtain the best construction loan for your California project requirements.

If you need assistance with deciding on a commercial construction loan,

contact us today! The team at

TMC engineering is deeply committed to assisting the community to deliver high-quality results. From

standards for safety to client satisfaction, we aim to provide you with valuable insight related to the

services our

team of experts provides.

We also offer a full suite of transportation construction solutions, from

asphalt paving to

striping and sealing to

concrete work—we’ve got all you need and more!